Policies and Procedures

A) Office Hours:

1) January and May through December – By Appointment Only

2) February through April 15th – Limited Hours – Normally Monday through Friday 10:00 AM to 4:00 PM

B) Communication:

1) We try to return all Emails in a timely manner during normal Monday through Friday, Non-Holiday, Business Hours.

2) For complex, lengthy, and/or after hours questions and/or needs, our communication preference is Email.

C) Turn Around Times:

We pride ourselves with excellent client services and turn around time.

1) Our standard turn around time varies on the time of year and what needs to be done.

2) During Tax Season, if you are not a new client and/or you do not need Accounting, Bookkeeping, and/or QuickBooks work done in order to prepare your tax returns, our standard cut off time is February 10th for the March 15th Due Date and March 10th for the April 15th Due Date.

3) During Tax Season, we generally do not take on a new client that needs Major Accounting, Bookkeeping, and/or QuickBooks work done. If you are a new client and/or you do need Accounting, Bookkeeping, and/or QuickBooks work done, Bob will give you an estimated time of completion.

4) Tax Season Extended Due Dates, if you are not a new client and/or you do not need Accounting, Bookkeeping, and/or QuickBooks work done in order to prepare your tax returns, our standard cut off time is August 15th for the September 15th Due Date and September 15th for the October 15th Due Date

5) Signed Tax Forms Returned, we need them returned to us timely please to give us enough time to finalize, e-file, obtain acceptance, and process tax returns. Our standard cut off time is five (5) days before an IRS/State tax due date. Two examples: We need signed tax forms by April 10th for the April 15th Due Date and October 10th for the October 15th Due Date. Any signed tax forms received less than five (5) days before an IRS/State due date will result in tax returns being late and clients will be responsible for all late filing interest and penalties.

6) On SSA W-2s and IRS 1099-MISCs, 1099-NECs, and other similar tax forms (that are due January 31st of each year), our cut off time to receive all of the information in order to meet the SSA and/or IRS due dates of January 31st is January 15th.

D) Tax Returns are Generally Prepped in Four (4) Steps:

Step #1 – Gather Info:

New Clients – (1) Need Prior Years Tax Return(s) on any Current Year Tax Return that you want Prepped and (2) Current Year Tax Docs (please see E below)

We will set up a meeting. We will look at Prior Years Tax Return(s) and Current Years Tax Docs and try to give a Free Quote.

Current Clients – Need Current Year Tax Docs Only (please see E below)

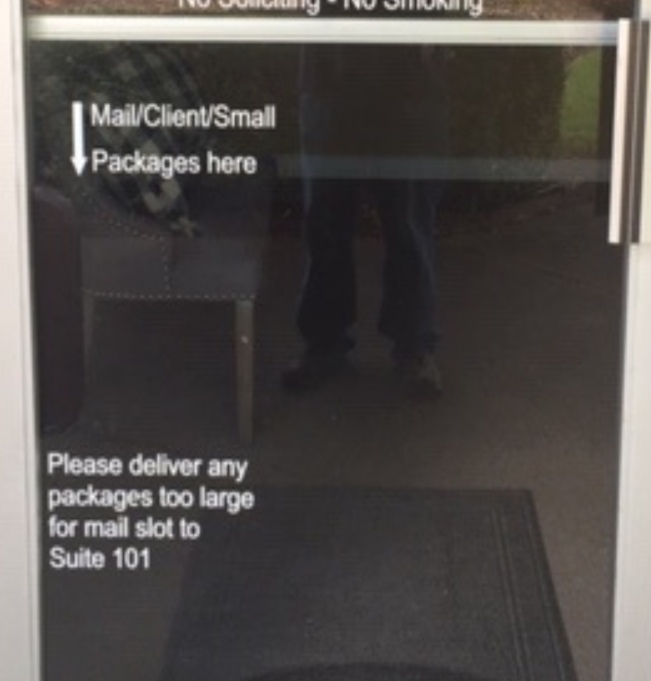

You can email documents to bob@bobbrowdercpa.com and/or you can conveniently drop off your documents at our office in the secure slot on our office door 24/7. Documents dropped off after hours will be picked up the next business morning. Or you can bring Docs during our Open Hours as well.

Step #2 – Prep and Review:

We prep and review the Current Year Tax Return(s).

Step #3 – Client Reviews and Approves:

When we finish with Step #2, we email One Draft for Client’s review, questions, comments, and/or approval. If Client requests additional drafts, there will be an additional fee.

Step #4 – Finishing Everything Up Including Client Pickup (if everything is not being done via emails), Payment to Us, and E-Filing:

When Client approves of the Tax Return(s), we schedule a pickup meeting so client can pickup everything, sign some IRS forms, and pay us. Please do not show up to pickup without making an appointment. We need time to print your tax return and get your tax folder ready to pickup. Also, we are required to e-file all IRS and State Taxes Returns. One of the forms you will be signing is the e-filing form(s) to give us your permission to e-file your tax return(s).

E) Summary of Current Year Tax Documents Needed.

1) This is when you tell us, via one page, that your personal data changed from the prior year. Some examples are: you obtained a new phone number, you obtained a new email address, you moved, you got married, you had a baby, you are now or not claiming a child (examples, divorced couples switch out years, child moves out).

2) All Official IRS / State / other Governmental Entities Documents / Forms / Letters / Notices / Returns

3) Other tax items that you think we might need within reason (we don’t need the kitchen sink, monthly statements, transactions acknowledgements, etc).

4) If you have a lot of receipts (examples: you own a business, you have rental property), we do not need and/or want a bunch of receipts. Please give us a one-page summary sheet of the total of your receipts broken down by category. NOTE: I always trust my clients and I do not need to see most of your receipts. However, please make sure and obtain, keep, and have all of your receipts in case the IRS or any other state or federal agency requests proof of said receipts. Happy to explain in greater detail.

For Our Paper Tax Clients:

5) Please remove all envelopes except the one big envelope you put everything in. Please do not give us unopened mail. When this happens, there will be an additional fee.

6) Please do not use staples. Staples do not work in our scanners. When there are an excessive amount of staples, there will be an additional fee.

For Our Electronic Tax Clients:

7) Pictures do not work. Please do not email us pictures of your tax documents. Please only email us, via one email, PDF copies (or Excel if in Excel format) of your tax documents.

For All Tax Clients:

8) Pictures do not work. Please do not email us pictures of your signed forms. Please only email us, via one email, PDF copies of your signed forms.

F) Our CPA Professional Tax Prep Fees are Due when you Pickup and/or when we email you e-filed and accepted copy of your Tax Return(s).

1) Our payment preference is Venmo (BobBrowderCPA)

2) Our second preference is Checks.

3) We do accept Cash.

4) We do accept all Credit Cards and E-Checks and you can pay at: https://secure.cpacharge.com/pages/bobbrowdercpa/payments

G) Additional Electronic and/or Paper Copies of your Tax Return(s).

1) We are happy to provide you an additional electronic and/or paper copy of your tax return(s) that we previously provided to you. There will be a $75 fee per tax return (per tax year) that is due before emailing or providing them.

2) Our Federal and State CPA Rules as well as our Errors and Omission (E&O) Insurance mandate and require that we send ALL sensitive electronic documents password protected. There are NO exceptions. Please do not ask for non-password protected copies. Thank you for your understanding.

H) We reserve the right to refuse service to anyone for a variety of reasons.

DID YOU KNOW?

You can drop off your documents 24/7 thru our secure slot on the main door to our office at your convenience.